What is a FICO score?

The Fair Isaac Corporation invented the FICO score a few decades ago, which makes it easy for lenders to gauge the risk of a possible consumer. The lender can vary from an auto dealer to mortgage. With just a quick glance to the three-digit number, the consumer’s risk of loan repayment will be determined.

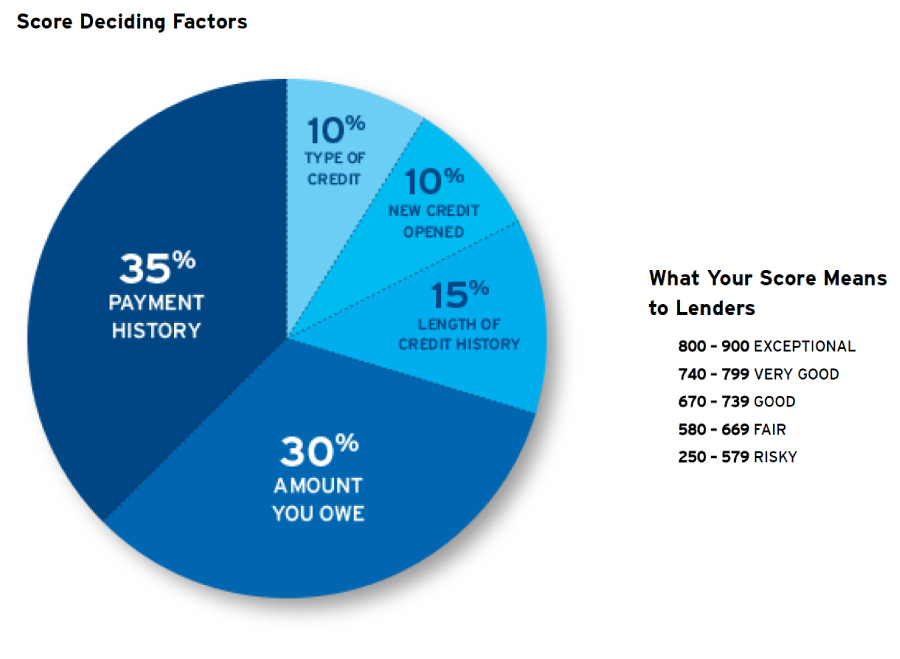

FICO scores are determined by the consumers themselves based on their credit history. A consumer can improve their credit scores by paying bills on time, repaying small loans on time and so on. It is important to have a good FICO score, somewhere above 670, for a consumer to receive a lower interest rate and save thousands of dollars.

What constitutes a FICO score?

The following are the factors which constitute a FICO score;

- Payment history – 35%

- Amounts owed – 30%

- Length of credit history – 15%

- New credit – 10%

- Mix of credit 10%

What does mix of credit include?

Mix of credit makes up about 10% of the FICO score. The reason why mix of credit is an integral part of FICO scoring is because the lenders want to see how a consumer manages multiple variations of credit as opposed to only one type of credit.

Those multiple variations include revolving accounts such as credit cards and home equity line of credit, and installment loans such as student loans, auto loans, mortgage loans and personal loans. It is important to try to diversify as to demonstrate to the creditor that the consumer is less of a risk because they have taken on all different types of credit. Moreover, it also demonstrates that they can diversify their credit portfolio a little better.

Hence, a consumer whose mix of credit only involves revolving accounts and no installment loans is not maximizing their score, and vice versa. However, this is tricky as the consumer should not be taking on unnecessary debt especially when they are trying to buy a new house. It may not be the best advice to suggest to a consumer to get an auto loan or a personal loan at that point in time.

FICO scores tailor the score based on what industry a consumer is seeking credit for. For example, there is FICO auto, FICO mortgage and so on. Auto lenders want to know what is the likelihood that an individual would default as an auto loan? Mortgage lenders want to know what is the likelihood that an individual would default as a mortgage loan.

There are industry options that are applied towards credit scores based on a certain industry. Therefore, diversifying a credit portfolio will help with that. For example, if a consumer has installment loans but no revolving and they are trying to apply for a credit card. The consumer might be scored at a disadvantage because they have not demonstrated any history on they handle credit cards. Similarly, for auto loans, if the consumer had some late payments on an installment revolving credit, but not on installment loans; this will hinder the auto loan score.

Why is it important to diversify mix of credit?

Hence, this is why it is important to diversify the mix of credit componenent of the score, not only to demonstrate that the consumer can handle multiple types of credit to lower the risk, but also that way it will help the consumer in different industries when applying for credit such as auto, mortgage, credit cards, so on and so forth.

What does a good mix of credit look like?

A good mix of credit includes one mortgage, one auto, three to five credit cards, but this is just based on general opinion as opposed to a set standard. There can also be two mortgages, two installments, six to ten revolving accounts. These are examples of a good blend.

Having too much installment will not really make a big deal on the mix of credit; it will probably hinder on balances and things like that, especially Vantage scoring. Having too many revolving accounts will not really make a big benefit in mix of credit but will certainly help in that scenario.

What does it mean for consumers?

When consumers start to repair credit, there are a few things they should keep in mind, like checking a box of types of credit to get. If a consumer has an auto loan, then they should focus on revolving accounts. If the consumer has all revolving accounts, but no installment loans, then the consumer should focus on getting a small personal loan or a mortgage loan. It is advisable to avoid an auto loan at this stage, until the credit score is better to avoid a high rate.

A consumer, for their own betterment, should take time and understand the affect of their scores and what it means.